Electricity bills may continue to shock you even as overall inflation eases. Here’s why.

While price hikes for gas, furniture, electronics and clothes are slowing down after a long stretch of sharp gains, one costly item isn’t expected to get cheaper anytime soon: electricity.

Economists say consumers should expect their electric bills to continue rising at a fast pace as liquefied natural gas, a key fuel for generating electricity, remains in short supply in the US and companies’ operating costs rise. Average US electricity prices could rise at a 10% clip again this year and possibly next, predicts Mark Wolfe, director of the National Energy Assistance Directors Association, even though economists have forecast overall inflation to ease to between 3% and 4% by year- end.

Electricity rates in Illinois, for example, could continue to surge following a rise last year. The utility ComEd has asked state regulators for a record $1.5 billion in price hikes over the next four years, starting in 2024.

If the next round of hikes wins approval, household electric bills in Illinois will increase by an average of $4.25 a month each year, for a cumulative increase of $17 a month by 2027. That means rates there will have more than doubled since 2012, according to the Illinois Public Interest Research Group, a nonprofit advocacy group.

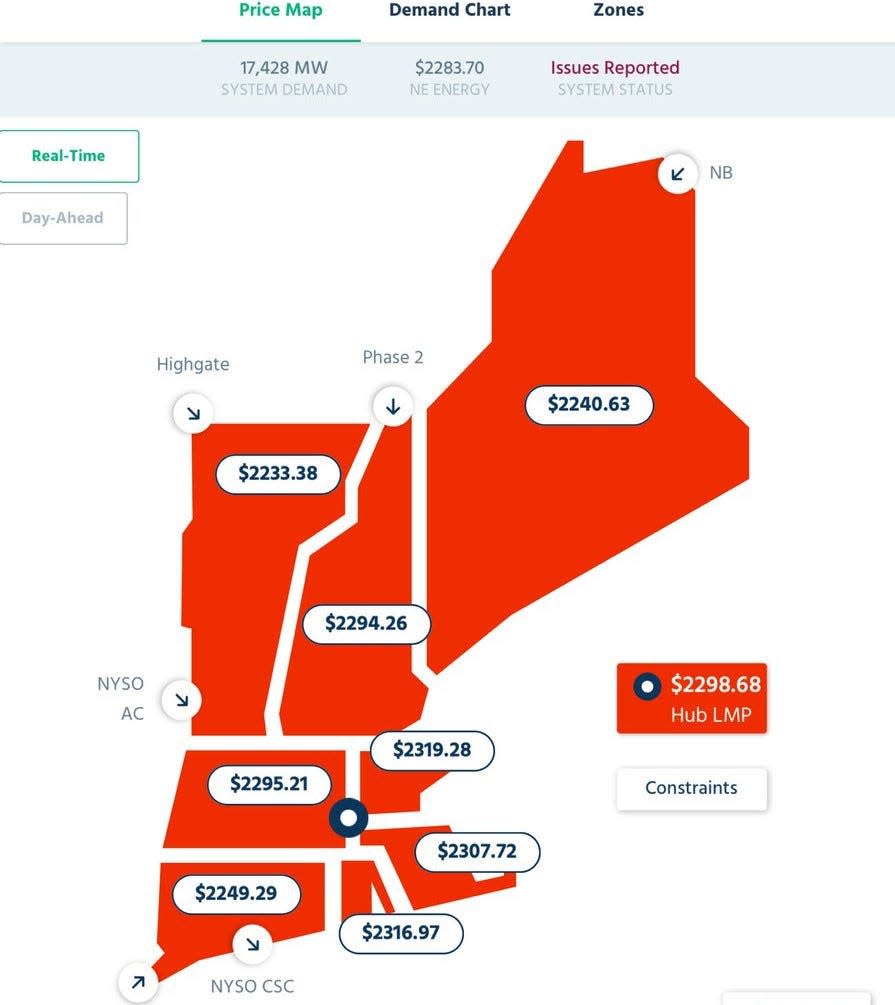

Electricity rates are also rising elsewhere. While Illinois saw the third-largest percentage increase (32%) last year, New Hampshire and Hawaii took the top two spots at 40% and 38%, according to a survey released earlier this month by Texas electric power company Payless Power.

“It’s fair to say, in aggregate, we’ll see upward pressure for 2023 on the cost consumers pay for electricity,” said Dallas Federal Reserve economist Jesse Thompson.

Why won’t electricity prices fall?

First, tighter supplies of liquefied natural gas, which fuels more than one-third of Americans’ electricity, has raised costs for consumers. Liquified natural gas is scarcer because the US is shipping record amounts to Europe to replace lost imports from Russia, which have dropped dramatically amid the war with Ukraine. That situation is unlikely to change anytime soon, Wolfe said.

Since June, the US has been the world’s top liquified natural gas exporter, he said, and companies were happy to reap higher prices as Europeans eagerly bought up the fuel to prepare for winter.

Starting from behind: An ‘invisible’ crisis: Already behind utility bills, many Americans face a tough winter

Price surges: US natural gas prices surge to 14-year high. What it means for your heating bill

Winter there has been mild so far, which lowered and stabilized natural gas prices. But Wolfe says don’t count on the calm to last with the continued war in Ukraine and China’s economic reopening that could make supplies scarce again. China is the world’s largest importer.

The unprecedented level of US exports are “for the first time in history, binding American household energy bills to global calamities,” Wolfe said in a letter to Energy Secretary Jennifer M. Granholm in October. That result is a “domestic energy pricing crisis. ”

More than 75% of Americans were concerned about their ability to pay their utility or electric bills, with 51% spending less to budget for the cost and one-quarter getting a second job to cover the expense, Payless Power said.

The second reason electricity bills will stay high is more familiar – labor shortages and tighter supplies have pushed up wages and other costs for utility companies.

“They’re experiencing inflation too – higher wages because of the tight labor force and materials,” said Thompson of the Dallas Federal Reserve. “The labor market is very tight, particularly in skilled trades like grid operators. Some of these people work with high power voltage and they need training. You can’t just send anyone up there.”

Plus, customers will have to pay for a more stable grid and grid upgrades, Thompson said. Companies’ operational costs have risen because companies must maintain a backup if their main power fails, he said.

“Nowhere in the world do people suffer power outages well,” he said. “Power production needs to be up. You won’t see demand falling much, even in a recession.”

Is there anything that can be done to lower electricity prices?

The path to lower electricity prices depends on the Department of Energy, Wolfe says.

The DOE “can’t control the price of natural gas, but it approves export licenses,” which determines the amount of liquefied natural gas that can be exported, he said. If the DOE limits exports, domestic prices can stay lower.

The US must also continue moving toward making renewable sources the primary source of electricity, experts say.

Additionally, Wolfe says the US should suspend The Jones Act, a century-old law requiring goods shipped between US ports to be done only by US-built, owned and crewed ships. Last July, six New England governors sent a letter to Granholm to consider this. Since there are zero liquefied natural gas vessels that meet this requirement, it’s impossible to ship US liquefied natural gas to American ports.

The law “limits competition and increases prices for companies and households,” Wolfe said. Without it, more liquefied natural gas could get to New England ports where it’s needed, and hopefully lower prices.

Oil backup: Where are the US strategic oil reserves? Here’s how many barrels remain and where they are

Pump prices: Gas prices are down but projected to rise again. How much will gas cost in 2023?

“People don’t pay attention to this sort of thing. It’s not like oil when people see it in gasoline prices,” Wolfe said. Oil and gasoline prices can also be buffered with releases from the US Strategic Petroleum Reserve, as the Biden administration has done this past year.

There is no Strategic Petroleum Reserve for natural gas.

“The only thing left to do is try to reduce consumption to protect yourself,” from soaring electric bills, he said.

Medora Lee is a money, markets and personal finance reporter at USA TODAY. You can reach her at [email protected] and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.

This article originally appeared on USA TODAY: Why electricity prices likely won’t cool with overall inflation

While price hikes for gas, furniture, electronics and clothes are slowing down after a long stretch of sharp gains, one costly item isn’t expected to get cheaper anytime soon: electricity. Economists say consumers should expect their electric bills to continue rising at a fast pace as liquefied natural gas, a key fuel for generating electricity,…

Recent Posts

Tags

About Us

Partner Links Backlink

Patner Links Getlinko